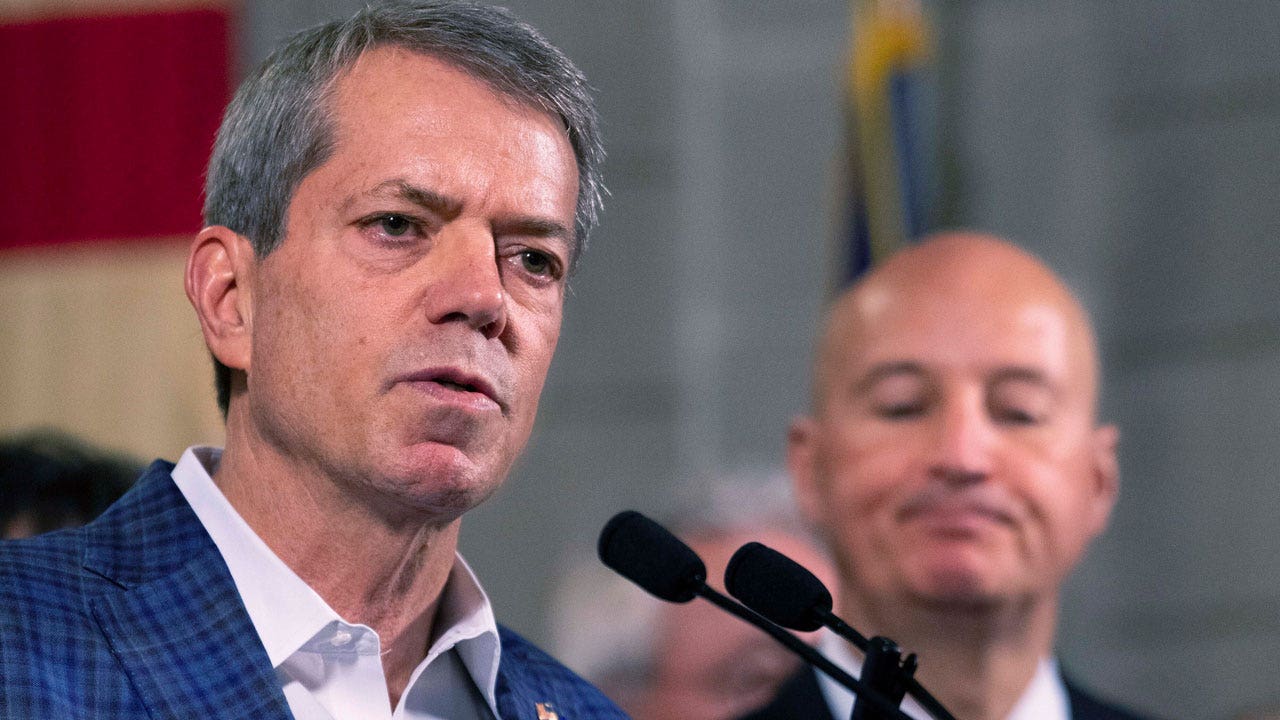

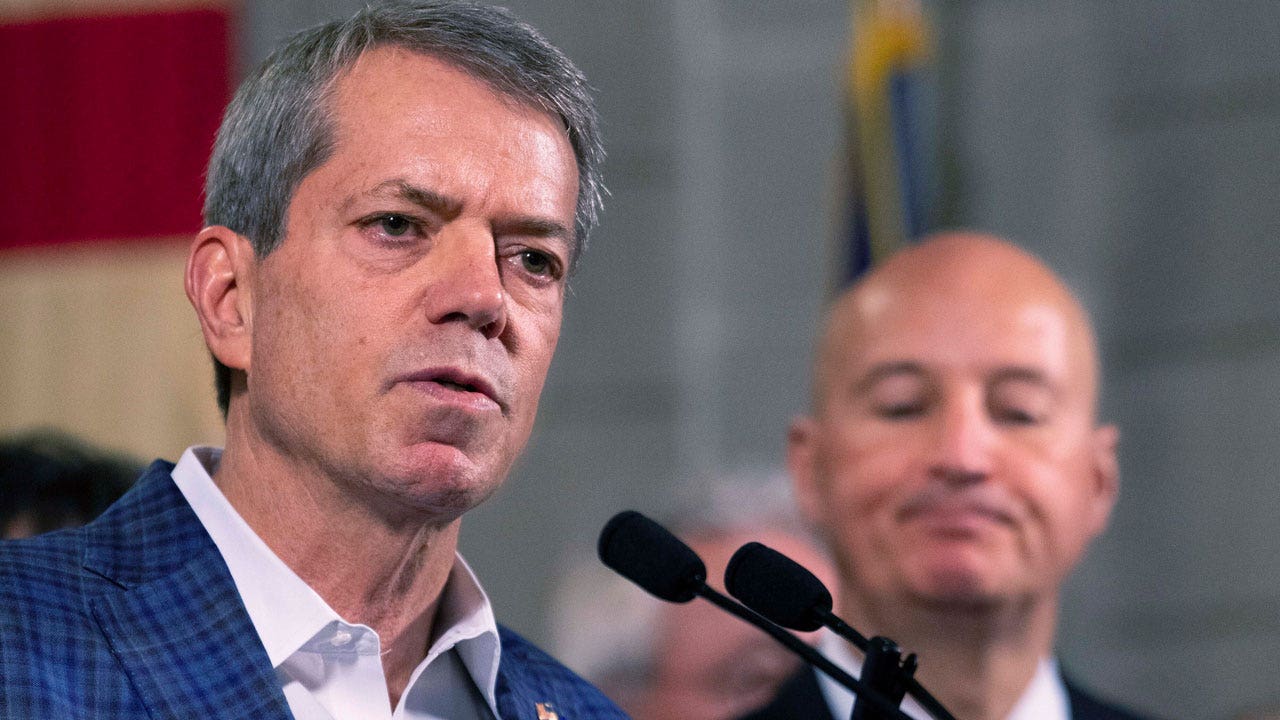

Nebraska’s newly minted Gov. Jim Pillen proposed Tuesday to vastly increase K-12 public education funding using money from the state’s huge cash reserve. It’s a plan that even those typically critical of Republican education reform efforts say holds promise.

The plan, spread over measures to be introduced by at least three lawmakers, proposes to increase education funding by $2.5 billion through 2030 while still cutting property taxes.

Pillen said the money would be in addition to current state aid funding to schools. Currently, Nebraska’s public schools are funded largely through local property taxes. The state provides equalization funding to schools to cover funding gaps in those districts with low tax revenues, high enrollment and/or large numbers of disadvantaged students.

NEBRASKA SWEARS IN JIM PILLEN AS ITS 41ST GOVERNOR

Pillen held a news conference Tuesday with Republican lawmakers to unveil a plan that would provide $1,500 for each student, primarily those in the 180 school districts that either don’t receive state equalization funding or receive less than $1,500 per student. Districts that receive more than $1,500 per student in state aid would not see that funding reduced.

‘No district will receive less aid than what they have today,’ Pillen said.

The plan would put up $1 billion in the first year, then $250 million each of the following six years, said Sen. Rob Clements of Elmwood, who plans to introduce the funding portion of the package. Another portion of the package would lower property taxes by limiting year-over-year tax-collection increases. It would enact a cap of a 3% increase in revenue per year.

‘This provides dollar-for-dollar property tax relief,’ Clements said.

Sen. Tom Briese of Albion, who introduced the revenue cap Tuesday, said the cap has built-in flexibility for those districts that have a need to raise more revenue in a year than the cap allows. They can do that with a supermajority vote of the school board or voters, he said. The cap does not apply to proposed school bond issues, which are adopted or rejected at the ballot box.

The package would also provide millions in additional funding to teach special education students.

‘Nebraska is nearly last in the country in education funding by the state,’ Briese said. ‘This package can chip away at that dynamic.’

Briese said proponents expect to be able to maintain the increased funding beyond 2030, but he did not detail how.

Nebraska ended the fiscal year in mid-2022 with a nearly $1 billion cash reserve, and fiscal forecasters predict a balance of $2.3 billion by this summer. Much of that additional revenue was garnered through federal pandemic recovery funding and boosts from rising inflation.

Pillen campaigned, in part, on changing Nebraska’s school-funding formula to a per-student basis, often repeating his mantra of ‘leave no child behind.’

Critics had thumped a plan that would have dumped equalization funding in favor of educational savings accounts — which have been proposed in at least a dozen other states this year — saying it could cost Nebraska’s largest districts up to $270 million.

But the plan announced Tuesday by Pillen was received with cautious optimism by those who usually find themselves squaring off against Republican-led education funding proposals.

Tim Royers, president of the Millard Education Association, spoke Tuesday for the Nebraska State Education Association, the union representing about 28,000 of the state’s public school teachers.

‘We think there’s a lot of promise in this,’ Royers said. ‘For a long time, there’s been a lack of state-level investment in our kids, and now we have a $2.5 billion proposal to do just that. That’s exactly what we wanted to hear.’

OpenSky Policy Institute, a Nebraska tax policy think tank that has long been critical of tax-cutting proposals, said it wants to study the plan to better gauge its long-term sustainability and affect on schools. But OpenSky executive director Rebecca Firestone offered rare praise for the effort.

‘We have long noted that the best way to address property taxes in Nebraska is to increase the share of state support for public K-12 education,’ she said.

Nebraska’s newly minted Gov. Jim Pillen proposed Tuesday to vastly increase K-12 public education funding using money from the state’s huge cash reserve. It’s a plan that even those typically critical of Republican education reform efforts say holds promise.

The plan, spread over measures to be introduced by at least three lawmakers, proposes to increase education funding by $2.5 billion through 2030 while still cutting property taxes.

Pillen said the money would be in addition to current state aid funding to schools. Currently, Nebraska’s public schools are funded largely through local property taxes. The state provides equalization funding to schools to cover funding gaps in those districts with low tax revenues, high enrollment and/or large numbers of disadvantaged students.

NEBRASKA SWEARS IN JIM PILLEN AS ITS 41ST GOVERNOR

Pillen held a news conference Tuesday with Republican lawmakers to unveil a plan that would provide $1,500 for each student, primarily those in the 180 school districts that either don’t receive state equalization funding or receive less than $1,500 per student. Districts that receive more than $1,500 per student in state aid would not see that funding reduced.

‘No district will receive less aid than what they have today,’ Pillen said.

The plan would put up $1 billion in the first year, then $250 million each of the following six years, said Sen. Rob Clements of Elmwood, who plans to introduce the funding portion of the package. Another portion of the package would lower property taxes by limiting year-over-year tax-collection increases. It would enact a cap of a 3% increase in revenue per year.

‘This provides dollar-for-dollar property tax relief,’ Clements said.

Sen. Tom Briese of Albion, who introduced the revenue cap Tuesday, said the cap has built-in flexibility for those districts that have a need to raise more revenue in a year than the cap allows. They can do that with a supermajority vote of the school board or voters, he said. The cap does not apply to proposed school bond issues, which are adopted or rejected at the ballot box.

The package would also provide millions in additional funding to teach special education students.

‘Nebraska is nearly last in the country in education funding by the state,’ Briese said. ‘This package can chip away at that dynamic.’

Briese said proponents expect to be able to maintain the increased funding beyond 2030, but he did not detail how.

Nebraska ended the fiscal year in mid-2022 with a nearly $1 billion cash reserve, and fiscal forecasters predict a balance of $2.3 billion by this summer. Much of that additional revenue was garnered through federal pandemic recovery funding and boosts from rising inflation.

Pillen campaigned, in part, on changing Nebraska’s school-funding formula to a per-student basis, often repeating his mantra of ‘leave no child behind.’

Critics had thumped a plan that would have dumped equalization funding in favor of educational savings accounts — which have been proposed in at least a dozen other states this year — saying it could cost Nebraska’s largest districts up to $270 million.

But the plan announced Tuesday by Pillen was received with cautious optimism by those who usually find themselves squaring off against Republican-led education funding proposals.

Tim Royers, president of the Millard Education Association, spoke Tuesday for the Nebraska State Education Association, the union representing about 28,000 of the state’s public school teachers.

‘We think there’s a lot of promise in this,’ Royers said. ‘For a long time, there’s been a lack of state-level investment in our kids, and now we have a $2.5 billion proposal to do just that. That’s exactly what we wanted to hear.’

OpenSky Policy Institute, a Nebraska tax policy think tank that has long been critical of tax-cutting proposals, said it wants to study the plan to better gauge its long-term sustainability and affect on schools. But OpenSky executive director Rebecca Firestone offered rare praise for the effort.

‘We have long noted that the best way to address property taxes in Nebraska is to increase the share of state support for public K-12 education,’ she said.